salt lake county sales tax

Sales Tax Analyst. County Sales Tax information registration support.

Great Salt Lake Monitoring Program Utah Department Of Environmental Quality

To review the rules in Utah visit our state-by-state guide.

. The December 2020 total local sales tax rate was also 7250. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668. Utah has a 485 sales tax and Salt Lake County collects an additional 135 so the minimum sales tax rate in Salt Lake County is 61999 not including any city or special district taxes.

State Local Option. The various taxes and fees assessed by the DMV include but are. How To- File for Tax Relief.

Puerto Rico has a 105 sales tax and Salt Lake County collects an additional 135 so the minimum sales tax rate in Salt Lake County is 61999 not including any city or special district taxes. 7705 or email to taxmasterutahgov. To find out the amount of all taxes and fees for your particular vehicle please call the DMV at 801 297-7780 or 1-800-DMV-UTAH 800-368-8824.

The latest sales tax rate for Salt Lake City UT. See All Dates Deadlines. Sales and Use Tax Salt Lake City Utah has a 775 sales and use tax for retail sales of tangible personal property and.

New values on properties are available from the Assessors office. The Salt Lake City sales tax rate is. Please check back in 2023 for the next Tax Sale.

The Tax Sale is closed for 2022. 274 rows Lowest sales tax 61 Highest sales tax 905 Utah Sales Tax. Salt Lake County Auditor.

Property taxes are levied at the state and local level based on assessed valuations established by elected county assessors and in the case of certain properties by the State Tax Commissions Property Tax Division. Tax rates are also available online at Utah Sales Use Tax Rates or you can contact the Tax Commission at 801-297-2200 or 1-800. The current total local sales tax rate in Salt Lake County UT is 7250.

Has impacted many state nexus laws and sales tax collection requirements. The Utah sales tax rate is currently. The latest sales tax rate for Murray UT.

See Publication 25 Sales and Use Tax General Information. Counties and cities can charge an additional local sales tax of up to 24 for a maximum possible combined sales tax of 835. File for Circuit Breaker Relief.

The South Salt Lake Utah sales tax is 705 consisting of 470 Utah state sales tax and 235 South Salt Lake local sales taxesThe local sales tax consists of a 135 county sales tax a 020 city sales tax and a 080 special district sales tax used to fund transportation districts local attractions etc. There are a total of 131 local tax jurisdictions across the state collecting an average local tax of 2108. Notice of Value Tax Changes will be sent from the Auditors office by mid-July.

The Salt Lake City Sales Tax is collected by the merchant on all qualifying sales made within Salt Lake City. The Salt Lake County Treasurers Office oversees several tax relief programs available to qualified homeowners. Please check back in 2023 for the next Tax Sale.

Cities towns and special districts within Salt Lake County collect additional local sales taxes with a maximum sales tax rate in Salt Lake County of 775. 91 rows This page lists the various sales use tax rates effective throughout Utah. The Tax Sale is closed for 2022.

If you would like information on property owned by Salt Lake County please contact Salt Lake County Real Estate at 385-468-0374. Did South Dakota v. The average cumulative sales tax rate between all of them is 749.

2020 rates included for use while preparing your income tax deduction. The county-level sales tax rate in Salt Lake County is 035 and all sales in Salt Lake County are also subject to the 485 Utah sales tax. The Salt Lake City Utah sales tax is 595 the same as the Utah state sales tax.

The County sales tax rate is. What is the tax rate in Salt Lake County. The Salt Lake County sales tax rate is.

For more information on sales use taxes see Pub 25 Sales and Use Tax General Information and other publications found here. Utah has a higher state sales tax than 538 of. Tax deeds for properties purchased at tax sale will be issued by the first part of July.

The 2018 United States Supreme Court decision in South Dakota v. This rate includes any state county city and local sales taxes. What is the sales tax rate in Salt Lake City Utah.

Average Sales Tax With Local. Job in Salt Lake City - Salt Lake County - UT Utah - USA 84101. Salt Lake County is located in Utah and contains around 11 cities towns and other locations.

Murray Details Murray UT is. The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes. As for zip codes there are around 64 of them.

The total sales tax rate in any given location can be broken down into state county city and special district rates. 66 years old or surviving spouse. While many other states allow counties and other localities to collect a local option sales tax Utah does not permit local sales taxes to be collected.

Utah has state sales tax of 485 and allows local governments to collect a local option sales tax of up to 335. Current Tax Sale List. For tax rates in other cities see Utah sales taxes by city and county.

The 775 sales tax rate in Salt Lake City consists of 48499 Utah state sales tax 135 Salt Lake County sales tax 05 Salt Lake City tax and 105 Special tax. Tax Relief Division 385 468-8300 Select Option 2. Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov.

Utah has 340 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. The most populous location in Salt Lake County Utah is Salt Lake City. This is the total of state county and city sales tax rates.

Auditors office will start accepting property valuation appeals August 1 through September 15 2022. The total sales tax rate in any given location can be broken down into state county city and special district rates. You may also call the Tax Commission at 801 297-7705 or toll free at 1-800-662-4335 ext.

Ad New State Sales Tax Registration. A Tax Sale is the public auction of any real property with taxes that have been delinquent for four years from the final tax payment deadline. 2022 Tax Sale Properties.

The minimum combined 2022 sales tax rate for Salt Lake City Utah is. UT is in Salt Lake County. A full list of these can be found below.

59-2-1301 et seq delinquencies 59-2- 1331 through 59-2-1334 and sales of property for delinquent taxes 59-2-1302 59-2-1303 and 59-2-1343 through 59-2-1364. Automating sales tax compliance can help your business keep compliant with changing sales. Wayfair Inc affect Utah.

The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors. Salt Lake City is in the following zip codes. 2020 rates included for use while preparing your income tax deduction.

You can print a 775 sales tax table here. Salt Lake County Assessors Office provides the public with the Fair Market Value of real and personal property through professionalism efficiency and courtesy. This rate includes any state county city and local sales taxes.

Advertising Card Saltair Beach Salt Lake City Utah Ut 76833586 Salt Lake City Utah Salt Lake City Lake

An Overview Of The Benefits Of Buying A Home Vs Renting Finance Plan Home Buying Mortgage Interest Rates

How Much Is Your 100 Really Worth Daily Infographic

Gorillas Don T Blog Saltair Utah Salt Lake City History Salt Lake City Utah Utah Lakes

2102 E Oak Manor Dr Sandy Ut 6 Beds 4 5 Baths Exterior Brick Manor Patio

639 S 900 E Salt Lake City Ut 5 Beds 3 Baths New Homes Salt Lake City Home

418 Milton Ave Salt Lake City Ut 4 Beds 4 Baths

Advertising Card Saltair Beach Salt Lake City Utah Ut 76833586 Salt Lake City Utah Salt Lake City Lake

4965 Holladay Pines Ct Holladay Ut 4 Beds 3 5 Baths Exterior Brick Tuscan House Redfin

Utah Collected Record 13 97 Billion In Tax Revenue In 2021 Here S Why Deseret News

Stone Haven Custom Home Alair Homes Salt Lake City Lake House Plans Custom Homes Custom Home Builders

1204 Browning Ave S Salt Lake City Ut 3 Beds 1 Bath House Exterior Brick Windermere Real Estate

4979 Cottonwood Ln Holladay Ut 3 Beds 2 5 Baths Cottonwood Salt Lake City Ut Salt Lake County

Salt Lake City Utah 1930 S Saltair Pavilion Rppc

Hungry Developers Eye Utah S Few Remaining Fruit Farms

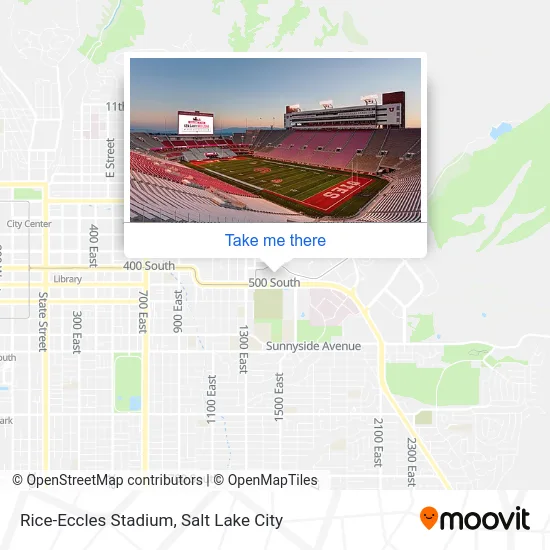

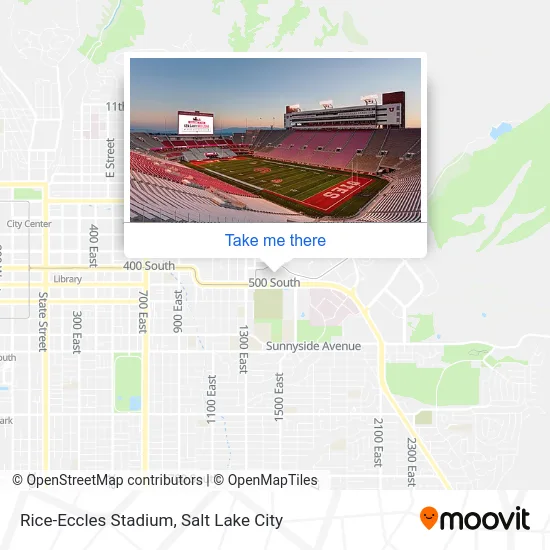

How To Get To Rice Eccles Stadium In Salt Lake City By Bus Or Light Rail

8257 S 1225 E Sandy Ut 3 Beds 2 Baths Exterior Brick Modern Flooring Cottonwood Heights